What Financial Awareness Really Means in Retirement

Why “Financial Awareness” Gets Misunderstood

January tends to put finances back in the spotlight. There’s talk of fresh starts, better habits, and being more “financially aware.” While the intention is good, the meaning often gets lost—especially for retirees.

For many people, financial awareness is assumed to mean checking balances more often, reviewing statements, or keeping a closer eye on the markets. Activity becomes the stand-in for understanding. But in retirement, that assumption can be misleading.

After you stop working, money behaves differently. You’re no longer focused on accumulation. You’re relying on what you’ve built to support your lifestyle—month after month, year after year. That shift changes what awareness actually looks like.

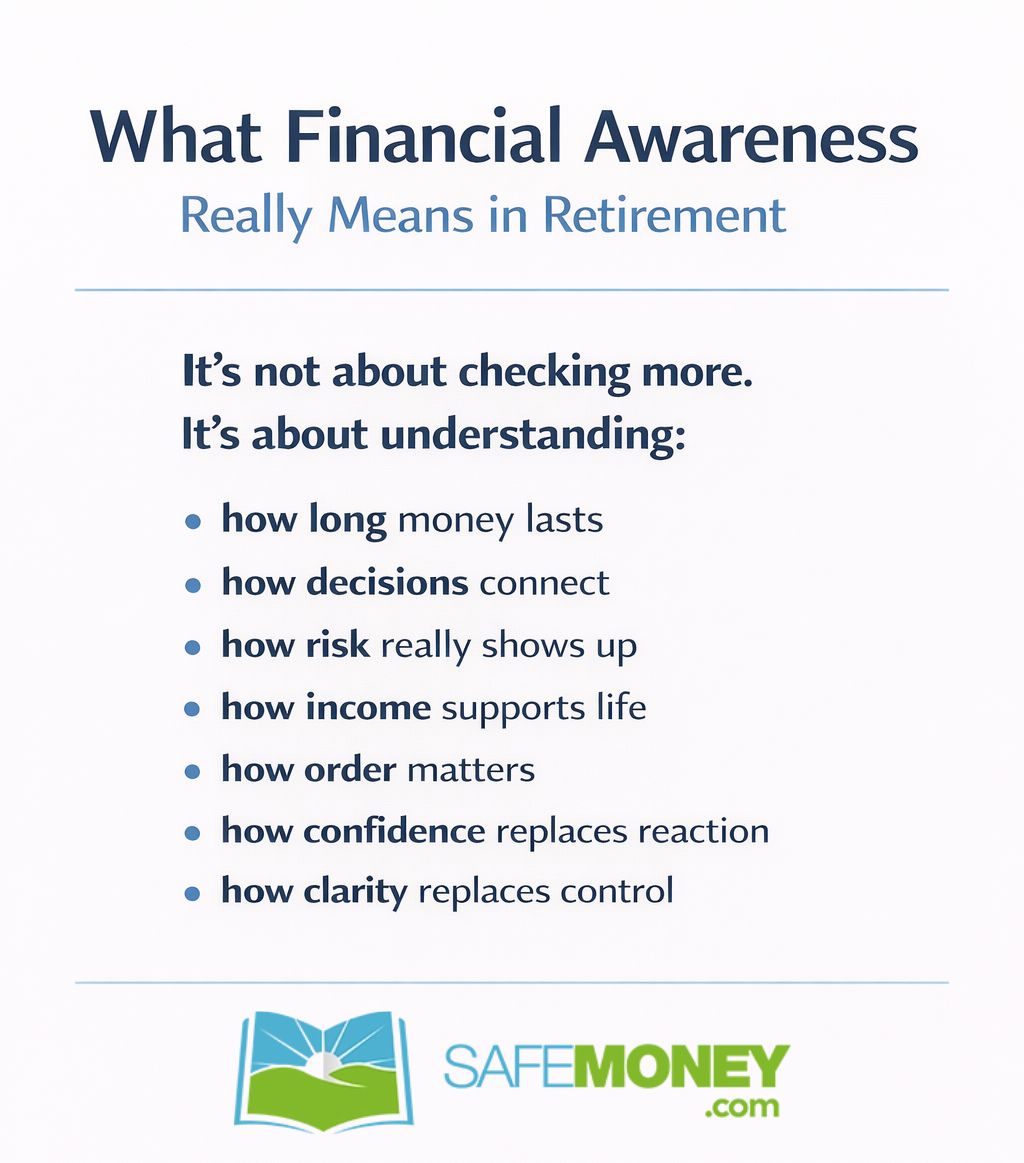

True financial awareness in retirement isn’t about how frequently you look at your money. It’s about whether you understand how your decisions work together and how your plan is designed to function over time.

This article explains what financial awareness really means after you stop working—and why understanding matters more than activity in retirement.

Section 1: Awareness Is Not Knowing Your Balance

Knowing your account balance feels comforting. It provides a clear number and a sense of control. But a balance is just a snapshot—a single moment frozen in time.

Retirement outcomes, on the other hand, are dynamic. They unfold over decades and are influenced by withdrawals, timing, market behavior, taxes, healthcare costs, and personal spending decisions.

A large balance doesn’t explain:

- How long your money is expected to last

- How it turns into reliable monthly income

- How risk shows up once withdrawals begin

- How changes today affect flexibility later

Two retirees with the same balance can experience very different retirements depending on how their money is structured and used.

Key learning: Knowing what you have is different from knowing how it works.

Section 2: Awareness Means Knowing How Decisions Connect

This is where financial awareness becomes truly educational.

In retirement, decisions don’t live in silos. One choice often affects several outcomes—sometimes immediately, sometimes years later. Many retirees don’t realize how interconnected their decisions are until something unexpected forces them to learn.

Connections people often overlook include:

- How spending decisions influence taxes

- How withdrawals affect future flexibility

- How healthcare costs can change timing and income needs

- How market volatility affects behavior, not just returns

Without awareness of these connections, retirees may feel like they’re solving one problem at a time. In reality, each decision is quietly shaping the rest of the plan.

Awareness means understanding these relationships before they create stress.

Key learning: Retirement decisions don’t live in silos—one choice can change several outcomes.

Section 3: Awareness vs. Activity

It’s easy to confuse being busy with being prepared.

Consider two retirees:

- One checks accounts constantly, tweaks allocations, and reacts to headlines

- The other understands how their plan is structured and why certain trade-offs were made

The first retiree is active. The second is aware.

Activity often comes from uncertainty. When people don’t fully understand how their plan works, they feel the need to keep doing something. Awareness reduces that urge because the structure already accounts for change.

This doesn’t mean aware retirees never review or adjust their plans. It means they’re responding from understanding—not anxiety.

Key learning: Calm usually comes from understanding, not control.

Section 4: Understanding Risk Beyond Market Drops

When people hear the word “risk,” they usually think about market losses. But retirement risk goes far beyond market performance.

Risk in retirement can include:

- Timing risk (needing income during down markets)

- Income interruption

- Unexpected healthcare expenses

- Making decisions under stress

Many retirees manage investment risk well but overlook retirement risk—the risks that show up when money is being used, not just invested.

True financial awareness means recognizing where vulnerability exists and understanding how different risks can compound if they’re not considered together.

Key learning: Managing investments is not the same as managing retirement risk.

Section 5: Awareness of Income vs. Assets

This builds naturally on the difference between having savings and having a retirement plan.

Assets explain ownership. Income explains sustainability.

In retirement, awareness shifts from “What do I own?” to “What supports my lifestyle?” Income awareness answers questions like:

- What shows up every month?

- What changes if markets drop?

- What stays steady regardless of conditions?

Without income awareness, retirees may feel confident during calm periods but uneasy during volatility. With it, they understand which parts of their plan are designed for consistency and which are exposed to change.

Key learning: Awareness means knowing what shows up every month—and why.

Section 6: Awareness Is Knowing the Order of Decisions

Many retirement mistakes don’t come from doing the wrong things. They come from doing the right things in the wrong order.

In retirement, sequencing matters:

- Structure before optimization

- Stability before growth

- Understanding before adjustment

When decisions are made out of order, even smart strategies can create unnecessary risk or stress. Awareness means knowing why certain steps come first and how later decisions build on earlier ones.

This clarity helps retirees avoid overcorrecting or chasing solutions without understanding the foundation.

Key learning: Many retirement mistakes come from doing the right things in the wrong order.

Section 7: How to Tell If You’re Financially Aware

Financial awareness isn’t measured by how often you check your accounts. It shows up as clarity.

Ask yourself:

- Can I explain my plan in plain language?

- Do I understand what would change if conditions shift?

- Do I know why my plan is built the way it is?

When retirees can answer these questions, they tend to feel less reactive and more confident. Awareness doesn’t eliminate uncertainty, but it reduces confusion.

Key learning: Awareness shows up as confidence and clarity—not constant monitoring.

Why Financial Awareness Matters More in Retirement

Financial awareness matters more in retirement because decisions are no longer theoretical—they’re lived.

As the year begins and conversations around financial awareness resurface, it’s worth remembering that awareness isn’t about perfection. It grows over time through learning and understanding, not constant activity.

Retirement doesn’t require watching every market move. It requires clarity about how your plan works, how decisions connect, and what supports your lifestyle.

Learning—not monitoring—is the goal. And awareness is what turns information into confidence.

Tootsie’s Takeaway

Tootsie’s Takeaway

I may not understand spreadsheets, but I do understand this: staring at my food bowl doesn’t make dinner come faster.

Financial awareness works the same way. Checking your money over and over doesn’t make a plan stronger—understanding why it’s there and how it works does. Less pacing. More peace. Now if you’ll excuse me, I’ve earned a nap.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: This article is for educational purposes only and is not intended as financial, investment, or tax advice. Individual situations vary. Readers should consult a qualified financial professional regarding their specific circumstances.

The post What Financial Awareness Really Means in Retirement first appeared on SafeMoney.com.

Featured Blogs

- Understanding Fixed Index Annuities in Today's Market

- Secure Retirement Plans: Annuities & Longevity Strategies

- New Tools, Same Goals: How Retirement Planning Is Evolving 🐾

- Why Market Volatility Hits Retirees Harder Than Workers

- Annuities: Your Forever Treat Bowl in Retirement 🐾

- The Retirement Paycheck: How to Replace Your Salary in Retirement

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?