Using Life Insurance to Protect Retirement Income

When most people think of life insurance, they think of it as a way to provide for loved ones after death. But life insurance also plays a powerful role in protecting retirement income for both you and your spouse.

This Life Insurance Awareness Month, let’s explore how the right policy can help keep your retirement plan on track.

The Retirement Income Challenge

Retirement planning isn’t just about accumulating savings—it’s about protecting those savings so they last. Without safeguards in place, unexpected events can drain your retirement income quickly.

- A premature death can leave a spouse without enough to cover living expenses.

- Medical bills or debt may eat into retirement assets.

- Market downturns can reduce account balances right when income is needed most.

Life insurance can be the “safety net” that ensures your retirement income strategy works as intended.

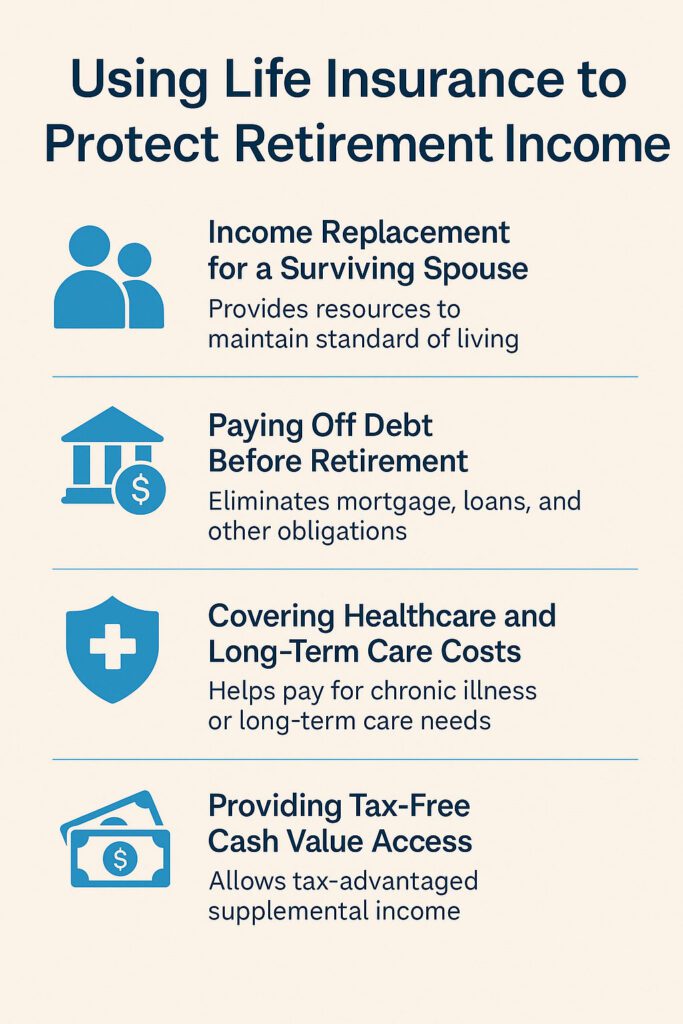

How Life Insurance Protects Your Retirement Plan

1. Income Replacement for a Surviving Spouse

Life insurance ensures that if one spouse passes away, the surviving partner has the resources to maintain their lifestyle. This is especially important if pensions, Social Security, or annuity payouts are reduced after one spouse dies.

2. Paying Off Debt Before Retirement

Mortgage, car loans, or credit card balances can put pressure on retirement income. Life insurance proceeds can eliminate those obligations, freeing up retirement funds for living expenses.

3. Covering Healthcare and Long-Term Care Costs

Some permanent life insurance policies can include riders that help cover chronic illness or long-term care costs, preventing these expenses from depleting retirement savings.

4. Providing Tax-Free Cash Value Access

Certain types of policies, such as Indexed Universal Life (IUL), allow policyholders to access accumulated cash value as supplemental, tax-advantaged income—if structured correctly and started early.

Example Scenario

Consider a couple, both age 60, planning to retire in five years. They depend on a combination of Social Security, a small pension, and investment withdrawals for retirement income.

If the husband passes away first, his pension ends and his wife’s Social Security benefit is reduced. Without additional protection, her income could drop by nearly 30%. But with life insurance in place, she receives a lump-sum benefit that replaces the lost income stream and secures her financial stability.

Life Insurance, Annuities, and IUL Together

- Life insurance protects surviving spouses and covers debts.

- Annuities provide guaranteed income streams for life.

- IUL strategies offer tax-free supplemental income for those with 10+ years to plan.

Together, these tools can strengthen any retirement plan.

Final Thoughts

Retirement planning is about more than growing assets—it’s about protecting them. By weaving life insurance into your retirement strategy, you ensure your income plan is secure, flexible, and built to withstand life’s uncertainties.

This Life Insurance Awareness Month, take the time to review your coverage and see how it aligns with your retirement goals.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: The information in this article is for educational purposes only and should not be considered financial, tax, or legal advice. Policy features and guarantees vary by state and insurer, and are subject to the claims-paying ability of the issuing company. Consult with a licensed financial professional before making coverage decisions.

The post Using Life Insurance to Protect Retirement Income first appeared on SafeMoney.com.

Featured Blogs

- Understanding Fixed Index Annuities in Today's Market

- Secure Retirement Plans: Annuities & Longevity Strategies

- New Tools, Same Goals: How Retirement Planning Is Evolving 🐾

- Why Market Volatility Hits Retirees Harder Than Workers

- Annuities: Your Forever Treat Bowl in Retirement 🐾

- The Retirement Paycheck: How to Replace Your Salary in Retirement

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?