Life Insurance vs. Annuities: Key Differences Explained

At first glance, life insurance and annuities might seem like opposites: one protects against dying too soon, the other protects against living too long. Yet both play critical roles in retirement and financial planning.

This Life Insurance Awareness Month, let’s explore how these two tools differ—and how they can work together to create lasting financial security.

What Is Life Insurance?

Life insurance provides a financial safety net for your loved ones after your death. You pay premiums, and in return, your beneficiaries receive a death benefit. Depending on the policy, life insurance can also build cash value over time.

Key purposes:

- Replaces income for dependents

- Pays off debts like mortgages or loans

- Covers final expenses

- Helps with estate planning or leaving a legacy

What Is an Annuity?

An annuity is a contract with an insurance company designed to provide a steady stream of income, often during retirement. You invest a lump sum or series of payments, and in return, the annuity can guarantee income for life.

Key purposes:

- Provides predictable retirement income

- Protects against outliving your savings

- Offers potential tax-deferred growth

- Some annuities include death benefits or long-term care riders

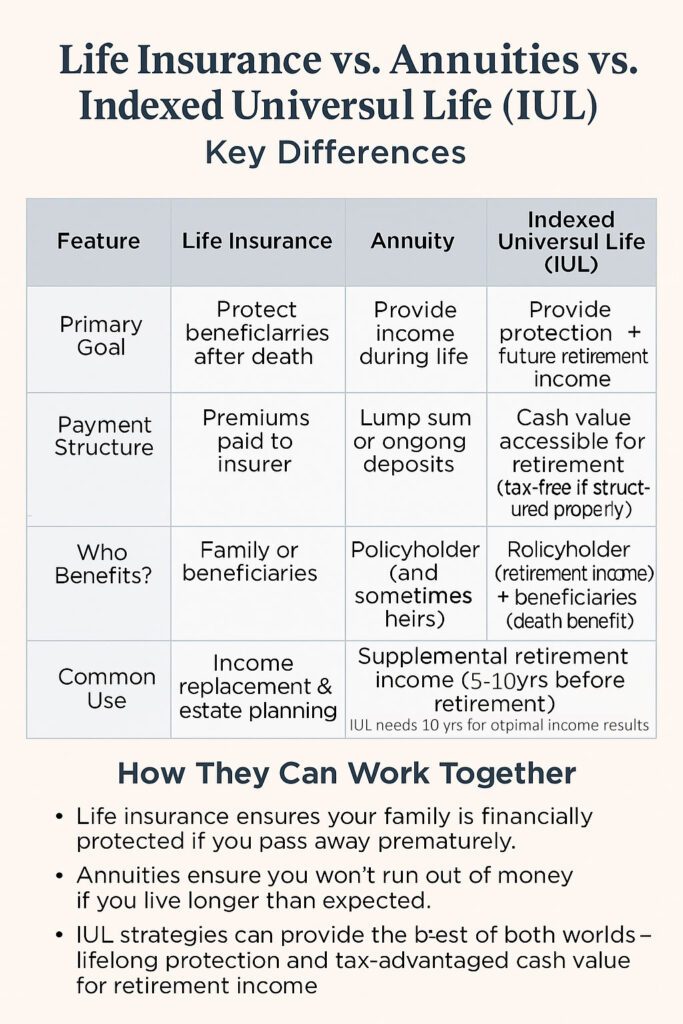

Side-by-Side Comparison

| Feature | Life Insurance | Annuity | Indexed Universal Life (IUL) |

|---|---|---|---|

| Primary Goal | Protect beneficiaries after death | Provide income during life | Provide protection + future retirement income |

| Payment Structure | Premiums paid to insurer | Lump sum or ongoing deposits | Flexible premiums (must be funded correctly) |

| Benefit Timing | Payout after death | Payout during lifetime | Cash value accessible for retirement (tax-free if structured properly) |

| Who Benefits? | Family or beneficiaries | Policyholder (and sometimes heirs) | Policyholder (retirement income) + beneficiaries (death benefit) |

| Common Use | Income replacement & estate planning | Retirement income & longevity protection | Supplemental retirement income (10+ yrs before retirement), tax-free withdrawals |

How They Can Work Together

Life insurance and annuities are not either/or choices. In fact, many retirement plans benefit from using both:

- Life insurance ensures your family is financially protected if you pass away prematurely.

- Annuities ensure you won’t run out of money if you live longer than expected.

- IUL strategies can provide the best of both worlds—offering lifelong protection and the ability to accumulate tax-advantaged cash value for supplemental retirement income, especially if you have 10+ years before retiring.

Together, they create balance—covering two of the biggest risks retirees face.

Where Indexed Universal Life (IUL) Fits In

While life insurance and annuities serve distinct roles, Indexed Universal Life (IUL) can bridge the gap for those planning ahead.

An IUL is a type of permanent life insurance that builds cash value tied to a market index, like the S&P 500. Unlike traditional retirement accounts, the growth is tax-deferred, and if structured properly, withdrawals can be accessed tax-free.

Best suited for:

- People with at least 10 years before retirement

- Looking for supplemental retirement income

- Interested in tax-advantaged strategies

- Wanting both life insurance protection and future income options

When designed and funded correctly, IULs can provide an additional stream of tax-free income in retirement—while still offering death benefit protection for loved ones.

Final Thoughts

While life insurance and annuities serve different purposes, they share the same goal: financial security. One protects your loved ones, the other protects your retirement lifestyle.

A financial professional can help determine the right mix for your unique situation.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: This information is for educational purposes only and is not financial, tax, or legal advice. Product availability, features, and guarantees vary by state and insurance company. Guarantees are subject to the claims-paying ability of the issuing insurer. Speak with a licensed financial professional before making decisions.

The post Life Insurance vs. Annuities: Key Differences Explained first appeared on SafeMoney.com.

Featured Blogs

- Understanding Fixed Index Annuities in Today's Market

- Secure Retirement Plans: Annuities & Longevity Strategies

- New Tools, Same Goals: How Retirement Planning Is Evolving 🐾

- Why Market Volatility Hits Retirees Harder Than Workers

- Annuities: Your Forever Treat Bowl in Retirement 🐾

- The Retirement Paycheck: How to Replace Your Salary in Retirement

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?