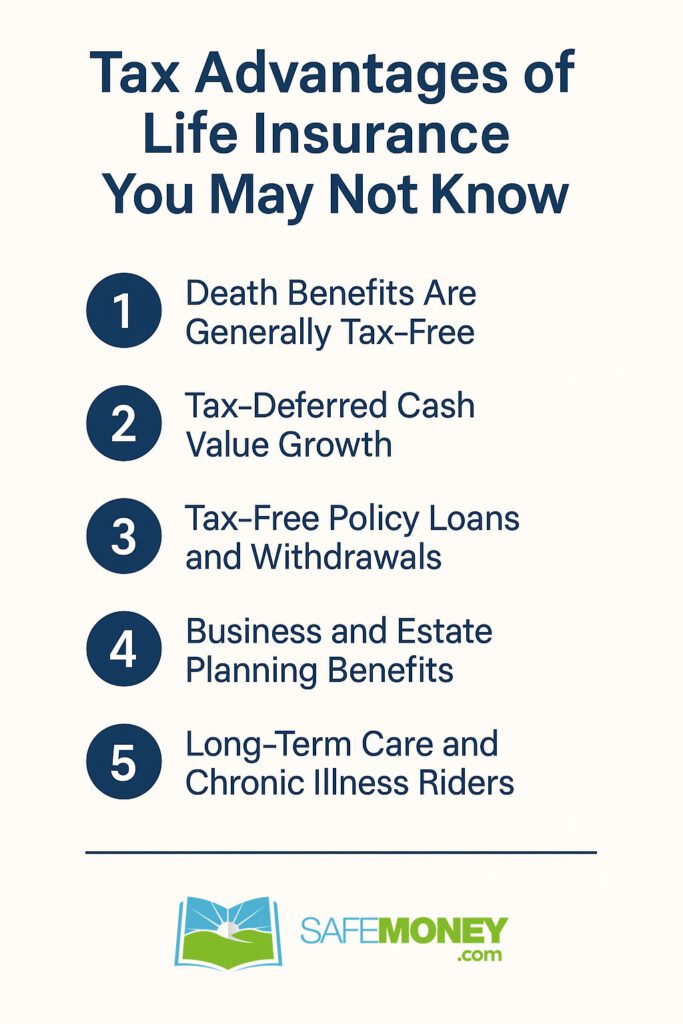

Tax Advantages of Life Insurance You May Not Know

When people think about life insurance, they usually focus on the protection it provides for loved ones. But life insurance also comes with unique tax advantages that make it one of the most versatile tools in a retirement and estate plan.

This Life Insurance Awareness Month, let’s explore the lesser-known tax benefits that can help you and your family preserve more wealth.

1. Death Benefits Are Generally Tax-Free

The most well-known advantage is that death benefit proceeds are paid to beneficiaries income tax-free in most cases. This means your family can use every dollar for living expenses, debt repayment, or other needs without worrying about tax bills.

For larger estates, life insurance can also provide liquidity to help pay estate taxes, avoiding forced sales of property or investments.

Death Benefit

Normally income tax-free to your beneficiaries.

But it can become part of your taxable estate if:

- You owned the policy at death, and your total estate value (including the death benefit) is larger than the estate tax exemption.

- Or, you named your estate as the beneficiary.

2. Tax-Deferred Cash Value Growth

Permanent policies like whole life, universal life, or indexed universal life (IUL) build cash value on a tax-deferred basis. That means you don’t pay taxes each year on the growth, unlike taxable investment accounts.

This feature allows money to compound faster over time, creating a powerful long-term asset inside your policy.

3. Tax-Free Policy Loans and Withdrawals

With proper structuring, policyholders can access cash value through policy loans or withdrawals on a tax-free basis. These funds can be used for:

- Supplemental retirement income

- College tuition for children or grandchildren

- Emergency expenses

For those with at least 10 years before retirement, an IUL strategy is often highlighted as a way to accumulate cash value for future, tax-advantaged income.

4. Business and Estate Planning Benefits

Life insurance is often used in buy-sell agreements or key-person coverage, providing tax-efficient solutions for business continuity. It can also equalize inheritances—for example, leaving real estate to one heir and life insurance proceeds to another.

5. Long-Term Care and Chronic Illness Riders

Some policies offer riders that allow tax-free access to death benefits if the insured suffers from a chronic or long-term illness. This provides another layer of protection without increasing taxable income.

Putting It All Together

The tax treatment of life insurance is one of its greatest advantages:

- Tax-free death benefits for loved ones

- Tax-deferred growth of cash value

- Tax-free loans/withdrawals if structured properly

- Tax-efficient business and estate planning

When combined with annuities for guaranteed income and IUL strategies for long-term, tax-advantaged growth, life insurance becomes a cornerstone of a well-rounded retirement plan.

Final Thoughts

While taxes can reduce the impact of many financial strategies, life insurance offers protections that stand out. These benefits, when properly planned, allow you to protect your family and preserve more wealth for the future.

This Life Insurance Awareness Month, review your coverage with a licensed professional to see how life insurance’s tax advantages could strengthen your financial plan.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: The information in this article is for educational purposes only and should not be considered financial, tax, or legal advice. Tax laws are complex and subject to change. Consult with a licensed professional and a qualified tax advisor before making financial decisions.

The post Tax Advantages of Life Insurance You May Not Know first appeared on SafeMoney.com.

Featured Blogs

- Understanding Fixed Index Annuities in Today's Market

- Secure Retirement Plans: Annuities & Longevity Strategies

- New Tools, Same Goals: How Retirement Planning Is Evolving 🐾

- Why Market Volatility Hits Retirees Harder Than Workers

- Annuities: Your Forever Treat Bowl in Retirement 🐾

- The Retirement Paycheck: How to Replace Your Salary in Retirement

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?