IUL Insurance Explained: Pros, Cons, and Misconceptions

Indexed Universal Life (IUL) insurance is one of the fastest-growing life insurance products in the U.S. Often marketed as a way to get the “best of both worlds”—protection for your loved ones and the ability to build tax-advantaged wealth—it’s popular among people looking for flexible strategies to supplement retirement income.

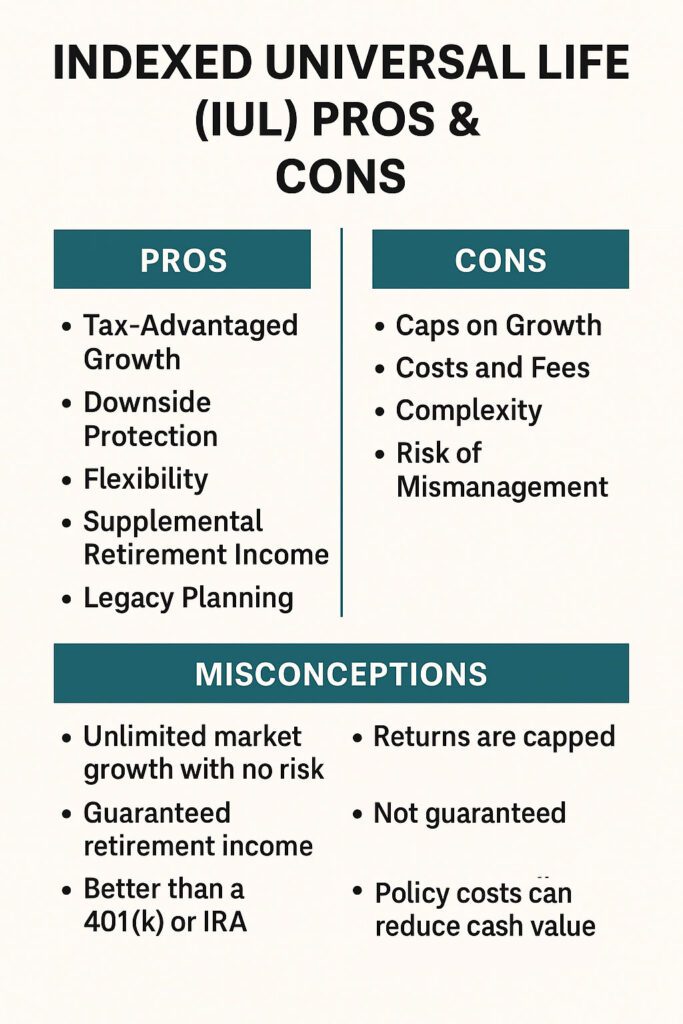

But is IUL really as good as it sounds? The truth is, IUL has clear benefits, but it also comes with drawbacks that aren’t always explained in flashy marketing pitches. This article will break down the pros, cons, and common myths about IUL so you can make an informed decision.

What Is Indexed Universal Life (IUL)?

IUL is a type of permanent life insurance that combines:

- A death benefit for your beneficiaries.

- A cash value component that grows based on the performance of a stock market index (like the S&P 500).

Unlike variable life insurance, your money is not directly invested in the market. Instead, your insurer credits interest to your account based on the index performance, subject to caps and floors (maximums and minimums).

This structure provides growth potential when markets rise while protecting against losses when markets fall.

Key Benefits of IUL

1. Tax-Advantaged Growth

- Cash value grows tax-deferred.

- If structured properly, you can access money later via policy loans or withdrawals tax-free.

This makes IUL attractive for retirement income planning.

2. Downside Protection

- IUL policies typically include a floor (often 0%), which means you won’t lose cash value due to market downturns.

- In volatile times, this safety net can be reassuring.

3. Flexibility

- Premiums and death benefits can be adjusted within certain limits.

- You can overfund a policy to maximize cash value accumulation.

4. Supplemental Retirement Income

- With at least 10 years before retirement, an IUL can build significant cash value that provides tax-free income streams later in life.

- Many see it as a complement to 401(k)s, IRAs, and annuities.

5. Legacy Planning

- Like all life insurance, it provides a death benefit to loved ones, ensuring financial protection in addition to cash value growth.

The Downsides of IUL

1. Caps on Growth

- While you’re protected from losses, your upside is limited. If the market rises 20%, you might only receive 10% due to caps.

2. Costs and Fees

- Insurance costs, administrative fees, and rider charges can eat into returns—especially in the early years.

- If underfunded, these costs can even cause the policy to lapse.

3. Complexity

- IUL isn’t a “set it and forget it” product. It requires monitoring and often works best with guidance from a knowledgeable advisor.

4. Risk of Mismanagement

- If the policy isn’t structured correctly—or if premiums aren’t funded properly—the tax advantages and retirement income potential may not materialize.

Common Misconceptions About IUL

“Unlimited market growth with no risk”

-

False. Returns are capped, and fees reduce credited interest.

False. Returns are capped, and fees reduce credited interest.

“Guaranteed retirement income”

-

Not guaranteed. Policy performance depends on funding, index returns, and insurance costs.

Not guaranteed. Policy performance depends on funding, index returns, and insurance costs.

“Better than a 401(k) or IRA”

-

Not necessarily. It’s a complement, not a replacement. Employer matches and pre-tax contributions in retirement accounts often come first.

Not necessarily. It’s a complement, not a replacement. Employer matches and pre-tax contributions in retirement accounts often come first.

“No downside at all”

-

While you won’t lose money directly to the market, policy costs can reduce cash value in flat or low-growth years.

While you won’t lose money directly to the market, policy costs can reduce cash value in flat or low-growth years.

Who Should Consider IUL?

- People with at least 10–15 years until retirement.

- High earners who have maxed out 401(k)s or IRAs and want another tax-advantaged savings option.

- Families who want both protection and potential supplemental income.

- Individuals seeking a long-term strategy, not a quick-return product.

Who Might Avoid IUL?

- Those looking for simple, low-cost coverage (a term life policy may be better).

- People with tight budgets who can’t consistently overfund premiums.

- Anyone unwilling to review and manage the policy regularly.

IUL in the Bigger Picture

When positioned properly, IUL can serve as part of a balanced retirement and protection strategy. Think of it as a supplemental tool—not the foundation of your plan. Paired with annuities, 401(k)s, IRAs, and traditional insurance, it adds flexibility and tax advantages.

But remember: the success of an IUL depends heavily on how it’s designed, funded, and managed.

Final Thoughts

Indexed Universal Life (IUL) can be a powerful strategy when used correctly, offering the chance for tax-advantaged retirement income and lifelong protection. But it’s not magic. The best approach is to understand the pros, cons, and limitations—and to work with a financial professional who can design the policy to fit your long-term goals.

This Life Insurance Awareness Month, take time to separate the marketing hype from the real benefits. Done right, an IUL may provide a “best of both worlds” solution: security for your family today and flexibility for your retirement tomorrow.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: This article is for educational purposes only and should not be considered financial, tax, or legal advice. Indexed Universal Life policies vary by insurer and state, and guarantees are subject to the claims-paying ability of the issuing company. Consult with a licensed financial professional before making decisions.

The post IUL Insurance Explained: Pros, Cons, and Misconceptions first appeared on SafeMoney.com.

Featured Blogs

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?