The Psychology of Retirement: Aligning Money and Mindset

When most people think about retirement, they picture numbers — savings balances, income plans, budgets.

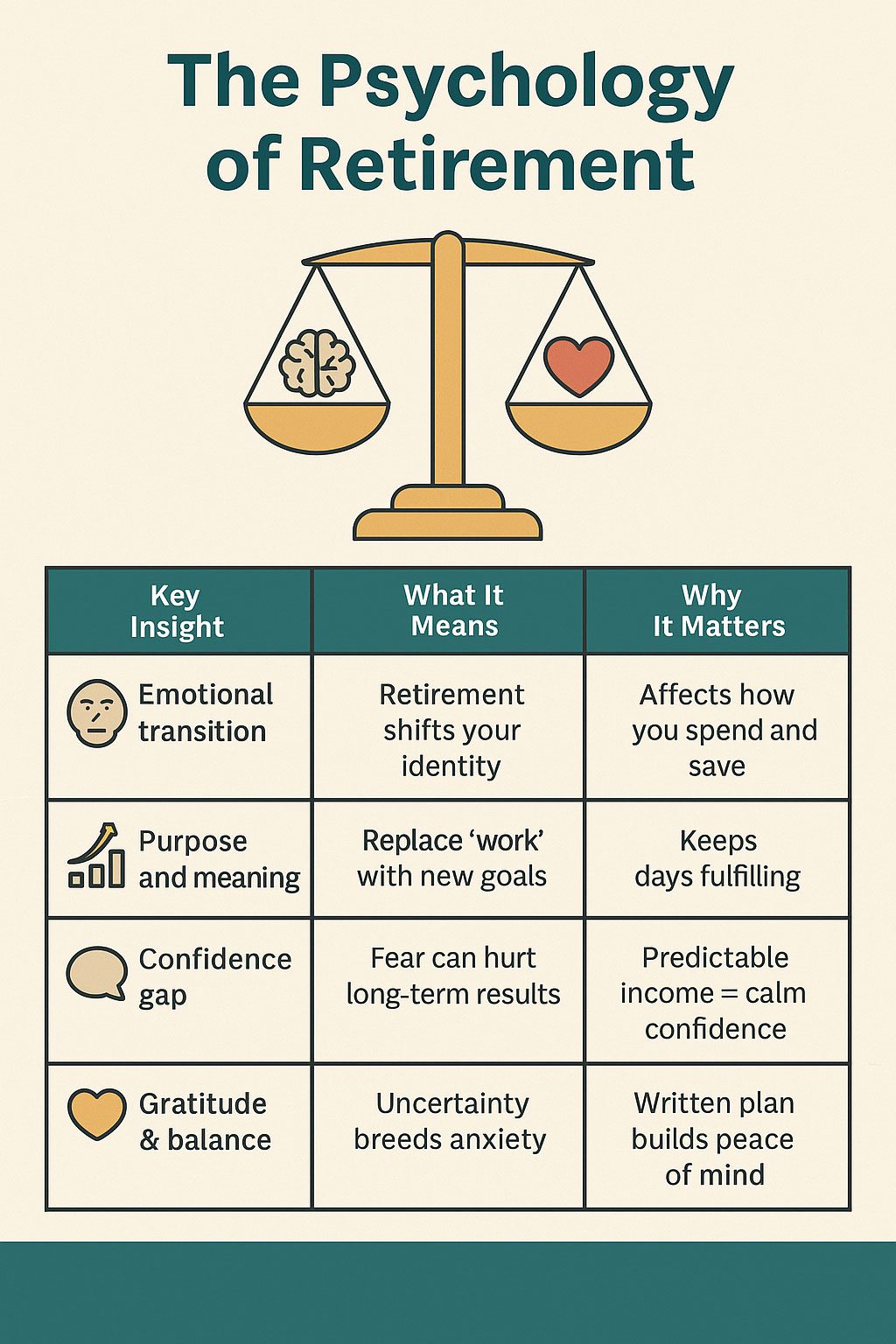

But the real secret to a successful retirement isn’t just about money. It’s about how you feel about it.

After decades of working, saving, and striving, retirement can bring emotional shifts that even the best financial plan can’t solve on its own. Understanding the psychology of retirement helps you align your money with your mindset — and live the life you’ve worked so hard to build.

1. The Emotional Transition Few Talk About

Retirement is more than a financial milestone — it’s a major life transition.

You go from structure and purpose to newfound freedom and unstructured time.

That freedom is wonderful, but it can also create anxiety or uncertainty, especially around spending.

Many retirees spend less than they can afford — not because they have to, but because they fear running out of money.

Tip: Remember that your savings were designed to be used.

Your goal isn’t to die with the largest balance — it’s to live with the greatest peace of mind.

2. From Paycheck to Purpose

During your working years, your identity is often tied to your career. When that chapter closes, it can leave a void that money alone can’t fill.

The happiest retirees find purpose in new ways — volunteering, mentoring, traveling, or pursuing passions they once put off.

These activities don’t just fill your time; they give meaning to your money.

Ask yourself:

“What do I want my days — and my dollars — to support?”

When your spending aligns with your values, financial confidence naturally follows.

3. Managing the Fear of Market Volatility

Behavioral finance teaches us that people feel losses twice as strongly as gains. In retirement, that fear can lead to emotional decision-making — like selling investments at the worst possible time.

A better approach is to plan for stability before volatility strikes.

Building predictable income streams (such as annuities or pensions) allows you to stay invested for growth without worrying about market dips.

When your essentials are covered by guaranteed income, you can ride out market swings calmly — and avoid emotionally costly mistakes.

4. The Confidence Gap: Knowing When You’re “Okay”

Many retirees admit they never really feel certain about how much they can spend.

That uncertainty creates stress — even among those who’ve saved well.

A simple retirement income plan that shows exactly where your money comes from each month can bridge that confidence gap.

Seeing your plan in black and white helps quiet the constant “what-if” questions that keep people up at night.

Clarity equals confidence.

5. The Power of Financial Gratitude

Money can buy comfort, but gratitude brings joy.

Studies show retirees who regularly reflect on the positives — time freedom, family, good health — experience greater satisfaction than those focused only on finances.

Try this small ritual: Each month, note three ways your money allowed you to live with meaning — whether it was helping a loved one, funding a trip, or simply buying peace of mind.

The emotional side of money deserves just as much attention as the numbers.

6. Balance: The Heart of a Happy Retirement

True financial well-being comes from balance — having enough to live comfortably, yet feeling free enough to enjoy it.

A retirement plan built with both logic and heart helps you stay confident when markets, health, or emotions fluctuate.

Money is the tool.

Mindset is the compass.

Together, they create the retirement you envisioned.

The Bottom Line

Retirement success isn’t measured by your portfolio size — it’s measured by how aligned your financial life is with your emotional well-being.

When you combine smart planning with a healthy mindset, you gain what every retiree truly wants: peace of mind.

Tootsie’s Takeaway

Tootsie’s Takeaway

“Retirement isn’t just about money — it’s about how you feel using it. Make sure your tail (and your plan) wag in the same direction.”

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of experience helping families navigate retirement and legacy planning, Brent is committed to making financial education simple, clear, and trustworthy.

Disclaimer: SafeMoney.com provides financial education only. For guidance on your specific situation, consult a licensed professional.

The post The Psychology of Retirement: Aligning Money and Mindset first appeared on SafeMoney.com.

Featured Blogs

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?