Life Insurance Awareness Month: Why It Matters in 2025

Each September, Life Insurance Awareness Month reminds us of a simple truth: tomorrow isn’t promised, but we can plan for it. For millions of American families, life insurance remains one of the most affordable and powerful ways to safeguard their financial future. Yet, many households are either uninsured or underinsured.

In 2025, with higher living costs, rising medical expenses, and longer life expectancies, protecting your loved ones is more important than ever.

Why Life Insurance Awareness Month Exists

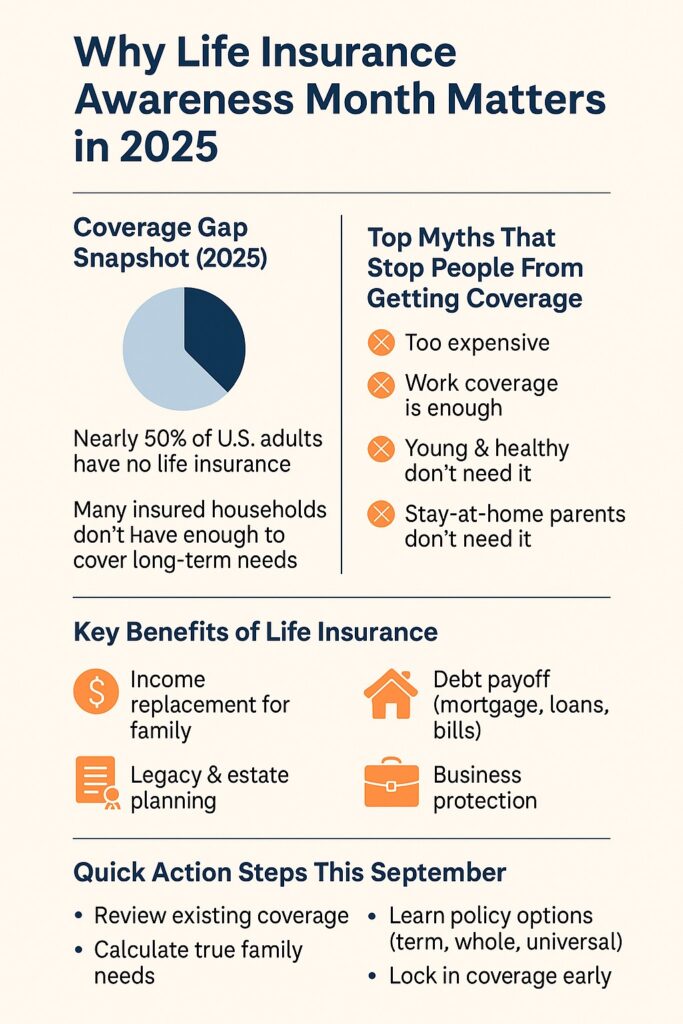

Life Insurance Awareness Month was created to highlight a national problem: too many families face financial hardship when the unexpected happens. According to LIMRA, nearly half of U.S. adults do not have any life insurance coverage. Of those who do, many lack enough to fully replace income, pay off debts, or provide for long-term needs.

This awareness campaign encourages people to learn the basics, explore their options, and take action before it’s too late.

The Reality of Coverage Gaps in 2025

Even in today’s digital age, misconceptions about life insurance keep people from getting covered. Common reasons people delay include:

- “It’s too expensive.” In truth, many term life policies cost less than a daily cup of coffee.

- “I have coverage at work.” Employer policies often cover only one or two times your salary—far less than what most families need.

- “I’m healthy and young.” Waiting means you risk higher premiums later—or worse, losing eligibility after a health change.

- “Stay-at-home parents don’t need it.” Their economic value, from childcare to household management, is significant and often overlooked.

Delaying coverage can leave a family exposed at the very moment they need protection most.

Why Life Insurance Matters More Now

With inflation, rising education costs, and uncertain markets, the financial burden on surviving spouses and children can be overwhelming without protection in place. Life insurance provides:

- Income replacement – ensuring loved ones can maintain their lifestyle.

- Debt protection – paying off mortgages, student loans, or medical bills.

- Legacy planning – leaving behind resources to support children, grandchildren, or causes you care about.

- Business continuity – covering key employees or funding a buy-sell agreement.

Think of it as a financial safety net—one you hope your family never needs but can’t afford to be without.

How Much Coverage Do You Need?

A common rule of thumb is 10–12 times your annual income, but the best way to calculate is by reviewing your family’s unique situation. Consider:

- Outstanding debts

- Mortgage or rent obligations

- College funding for children

- Everyday living expenses for surviving family members

- Long-term retirement needs for a spouse

A professional advisor can walk you through these numbers and recommend a policy type—term, whole life, universal, or a blend—that best fits your needs.

Taking Action This September

Life Insurance Awareness Month is more than just a campaign—it’s a reminder to pause and ask: If something happened to me tomorrow, would my family be financially secure?

Here are simple steps to get started:

- Review your current coverage – Do you have enough? Is it still aligned with your goals?

- Get a needs analysis – Work with a financial professional to run the numbers.

- Understand your options – Learn the differences between term, whole, and universal life insurance.

- Don’t delay – Lock in coverage while you’re healthy and premiums are low.

Final Thoughts

September is the perfect time to review your protection strategy. Life insurance isn’t about you—it’s about the people you love most. A policy ensures that no matter what happens, their financial future is protected.

If you’re unsure where to start, take the time this month to connect with a qualified advisor. An informed decision today can create peace of mind for decades to come.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Written by Brent Meyer, founder of SafeMoney.com. With more than 20 years of hands-on experience in annuities and retirement planning, Brent is committed to helping Americans make informed, confident financial decisions.

Disclaimer: The information in this article is for educational purposes only and should not be considered financial, tax, or legal advice. Life insurance products, features, and benefits vary by state and by company. Policy guarantees are subject to the claims-paying ability of the issuing insurer. Before making any decisions regarding life insurance, consult with a licensed financial professional who can evaluate your individual circumstances and goals.

The post Life Insurance Awareness Month: Why It Matters in 2025 first appeared on SafeMoney.com.

Featured Blogs

- Understanding Fixed Index Annuities in Today's Market

- Secure Retirement Plans: Annuities & Longevity Strategies

- New Tools, Same Goals: How Retirement Planning Is Evolving 🐾

- Why Market Volatility Hits Retirees Harder Than Workers

- Annuities: Your Forever Treat Bowl in Retirement 🐾

- The Retirement Paycheck: How to Replace Your Salary in Retirement

- Secure Your Retirement with Safe Income Strategies

- 3 Biggest Retirement Income Mistakes After 50

- Why Retirement Income Matters More Than Account Savings

- What Financial Awareness Really Means in Retirement

- Having Savings Isn’t the Same as Having a Plan

- The Secret to Retirement Confidence Is Structure, Not Luck

- What Retirees Should Review Before the New Year

- Preparing Your Retirement Income for the Year Ahead

- 🎾 Fetch Calm, Not Chaos: Keeping Retirement Income Steady

- Missed Medicare Open Enrollment? What Retirees Can Do Now

- Staying Calm in December Markets: A Bulldog’s Guide to Balance

- Why December Is Ideal for Securing Lifetime Income

- December Medicare Checkup: What to Review Before Jan 1

- 5 Year-End Retirement Blind Spots to Avoid in 2025

- Your December Retirement Checkup Guide

- Black Friday Savings Tips Retirees Can Use This Holiday

- The Retirement Spending Smile Explained

- A Thanksgiving Lesson in Gratitude, Guidance & Guaranteed Income

- Give Thanks, Then Revisit Your Retirement Plan

- How to Build Financial Resilience in Uncertain Times

- Smart Charitable Giving Before Year-End

- Understanding RMDs: What Every Retiree Needs to Know Before Age 73

- The Retirement Income Gap: Will Your Money Last?

- The Psychology of Retirement: Aligning Money and Mindset

- The 3-Bucket Plan for Calm Cash Flow

- How to Stress-Test Your Retirement Plan

- Why a Year-End Portfolio Review Could Save Your Retirement

- 4 Retirement Myths That Can Cost You Big Time

- Is Your Medicare Specialist on the Calendar Yet?

- The Retirement Tax Trap: Moves to Make Before Year-End

- How to Use Catch-Up Contributions to Boost Your Retirement

- Why Retirement Financial Literacy Matters More Than Ever

- Why Guaranteed Lifetime Income Is Your Next Big Priority

- Your Year-End Financial Planning Checklist for 2026

- The Hidden Link Between Health Costs and Retirement Security

- Tootsie Tuesday Starts Nov. 4—Stay Tuned!

- Keeping Your Financial Plan on Track After Retirement

- Medicare Open Enrollment Starts Today: What You Need to Know

- Protect What You’ve Built: Managing Risk in Retirement

- Turning Savings Into Income: Your Lifetime Paycheck Plan

- The Cost of Waiting: Don’t Delay Your Financial Plan

- How to Calculate Your Retirement Income Gap (Why It Matters)

- October Is National Financial Planning Awareness Month

- The Great Wealth Transfer: Baby Boomers Passing Trillions

- Permanent vs. Term Life Insurance: What’s the Difference?

- One Big Beautiful Bill: What Retirees Need to Know

- The Role of Life Insurance in a Comprehensive Retirement

- IUL Insurance Explained: Pros, Cons, and Misconceptions

- The Role of Life Insurance in Estate Planning

- Tax Advantages of Life Insurance You May Not Know

- Using Life Insurance to Protect Retirement Income

- Life Insurance vs. Annuities: Key Differences Explained

- How Much Life Insurance Do You Really Need?

- 5 Life Insurance Myths That Could Cost Your Family

- Life Insurance Awareness Month: Why It Matters in 2025

- What to Do After You’ve Made Your Will or Trust

- Passing Down More Than Money: Letters & Legacy Planning

- The Hidden Risks of DIY Wills and How to Avoid Them

- TOD, POD & Beneficiaries: Tools to Avoid Probate

- Probate Explained: What It Is and How to Avoid It

- Naming Beneficiaries: The Hidden Danger of Getting It Wrong

- Spotlight Series: Michael Dinich of Your Money Matters, Inc.

- Wills vs. Trusts: Do You Need One, the Other—or Both?

- What Really Happens If You Die Without a Will in Place?

- Why You Still Need a Will—Even If You’re Retired

- Quarles and Herring of Financial Longevity Advisory

- From Retirement Ready to Legacy Ready: What Comes Next?

- What’s Your Retirement Goal—and Are You on Track?

- How Inflation Quietly Erodes Your Retirement Income

- Peace of Mind in Retirement Starts With a Plan

- Avoiding Retirement Surprises Most People Miss

- How Social Security Timing Impacts Retirement Income

- Smart Tax Moves That Boost Retirement Income Longevity

- Spotlight Series Interview with Paul R. Lowe

- Avoiding Market Risks in Retirement: Why It Matters

- How to Create a Retirement Paycheck That Lasts

- How to Fill the Gaps in Your Retirement Income Plan

- Guardian Investment Advisors: Plan with Purpose

- Is Your Retirement Plan Ready for the Real World?

- A Holistic Retirement Strategy with Marlene Woodyard

- 3 Retirement Mistakes That Can Still Be Fixed in 2025

- The Power of Zero: Protecting Retirement from Losses

- What Happens If You Outlive Your Retirement Savings?